- PreSeed Now

- Posts

- Yes now... or Yes later?

Yes now... or Yes later?

Good With wants to change the way lenders think about rejections

We’ve looked at problems with the current credit scoring system before, and today let’s look at another startup looking to shake up the space by appealing to the good business sense of financial inclusion.

Read on to meet Good With… But first:

A shout out to serial tech founder Alex Depledge, who has become the first-ever entrepreneurship adviser to the Treasury, working with Chancellor Rachel Reeves.

– Martin

Good With wants to help lenders and borrowers with ‘yes-now or yes-later’

Good With co-founders Gabriela Isas and Ellie Kallis

In summary:

Premium subscribers get the full version of this article, plus a TLDR summary right here, and access to our Startup Tracker for updates about what this startup does next.

We’re all familiar with traditional credit scores, which are based around your historical ability to manage debt. But the big, established credit reference agencies aren’t perfect, and there are holes in their armour.

For example, they tend not to handle buy-now-pay-later loans very well. We previously looked at a startup looking to deal with that problem.

Another problem is the currently prevailing credit score models can exclude people who for whatever reason don’t fit the model of being ‘creditworthy’, despite having the capability to take out and repay a loan.

“The basic premise of the existing credit scoring system is that people have a credit history, and you have to borrow to prove you can borrow. It's sort of like getting that first job; you don't have the experience, and so the banks don't know how to judge people,” explains Ellie Kallis, chief scientific officer and co-founder at Good With, a startup with a new take on solving this problem.

“As such, some people are misjudged as being low risk when they're high risk, putting them at risk of unaffordable debt and vice versa. Really good customers, who potentially could have huge value to the banks, are not given the opportunity to borrow, and then they're penalised. So it's a double blow. Everybody loses.”

CEO and founder Gabriela Isas says Good With’s own research has pegged the size of the problem in the UK alone as affecting 16.2 million adults.

The startup is tackling this problem with a solution that uses behavioural data insights and psychometric and psychological data insights to produce what Isas describes as “a more accurate credit risk assessment of where a person is today and where potentially they'll be in the future.

“We’re giving them the tools to build up their financial capability and come back to the bank. So we are calling it a ‘safe journey to yes’.”

How it works

Lenders can integrate Good With into their application process via an API. If at any stage in the application process, an applicant submits information that would get them rejected, they can get transferred into the Good With process.

Kallis explains that they are then invited to spend a few minutes answering questions and to connect their bank accounts up via Open Banking.

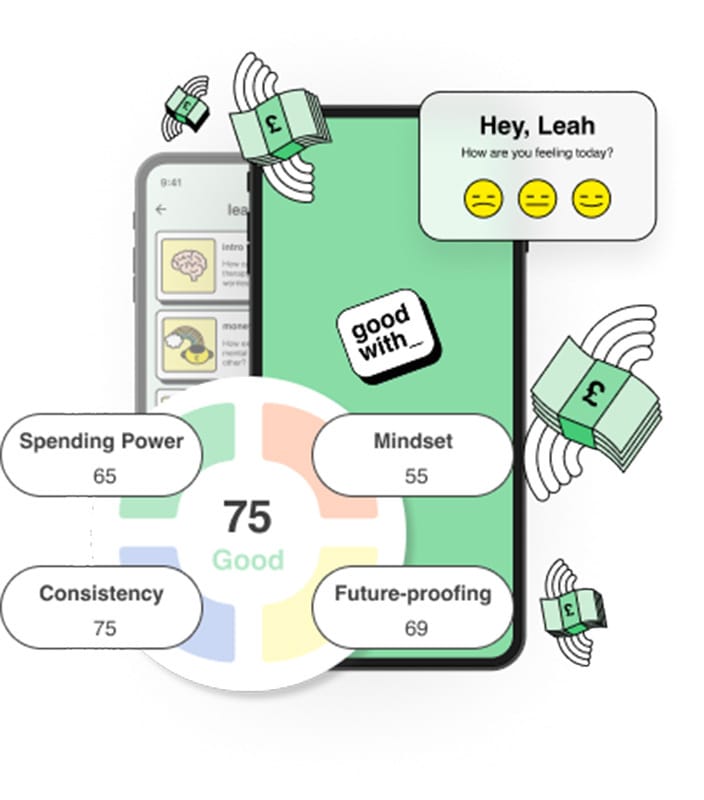

Good With collates data from both the psychometric and psychological assessments, and data about the applicant’s financial behaviour from their bank accounts. It sends back to the lender around 25 different data points, alongside a ‘readiness scorer–an overall representation of financial capability–and four key ‘sub-scores’ representing what the startup sees as key determinants of financial health.

But if the applicant is still rejected, Good With doesn’t stop there. It can help them adjust their behaviour to get a ‘yes’ in the future, using its ‘FinIQ’ education pathways.

“At the same time of creating a risk profile about somebody, we also capture enough data to be able to personalise an intervention,” Kallis explains.

“If their main challenge is their mindset, we might send them down a confidence-learning pathway around money, or if it's around erratic spending, we would help them to budget. This is where our ‘safe journey to yes’ comes in… Rather than just saying ‘see you later’, which is what happens right now across the industry, they would be offered a bespoke, personalised journey to improve their credit score, to improve their financial capability.”

What’s more, Good With tracks their progress on that pathway and reports it to the lender, so the lender can decide when they’re ready to offer a loan to that person.

“It makes the journey for the applicant much less stressful. It gives them a specific thing to aim for, and it means banks can reduce their procurement costs as well, because customers that they previously rejected, they can now see as being good customers, and they can offer them what they want,” Kallis adds.

The story so far

Isas began her career in the US and worked in a range of roles across marketing, innovation, and transformation around the world. Along the way, she moved to the UK and eventually got drawn into the world of tech entrepreneurship inspired by her own experiences with borrowing.

“I got into a lot of debt at university. And in the States, credit cards are just thrown at people, much like they can be here,” Isas says.

“But there is no education, there is no safeguarding, there are no programmes that can help you. And what I realised quickly is that as one of the first people in my family to go to university, I was then struggling to find a job that would pay me more, rather than a job that I really wanted to do after having graduated.

“So it was a real shame and anxiety-producing experience that really left its mark… And then moving to the UK, realised that we're not doing a good job here either.”

With an idea for a solution, Isas successfully applied for a grant to fund its development. This allowed her to hire an initial team in late 2021, which included Kallis.

Kallis has a PhD in cognitive neuroscience and had previously worked in data science for a financial services company.

“What really struck me [in that role] was that even though I was working with really, really smart mathematicians, there was a real absence of behavioural insight in the team. And that seems to be kind of across the board in financial services, there's an absence of real understanding of the person that you're making inferences about.”

And Kallis had personal experiences from her time as a teenage mother that drew her to the Good With mission.

“I was one of these people who probably shouldn't have been lent to and borrowed out of kind of necessity, but really had no idea how to manage it properly. I didn't have the skills, and it just led to a huge amount of stress, and anxiety, and bailiffs, and food banks and all sorts of shameful experiences.”

All of this made her an obvious choice to be hired at the nascent Good With, and she quickly became a co-founder alongside Isas.

“We realised that our chalk-and-cheese skill sets were actually the perfect jigsaw puzzle to really drive this thing,” Kallis says.

Good With began as a B2C proposition before the founders realised that the really potent market was financial services companies. The startup is now in the process of launching five trials with a variety of businesses in the space, and Kallis says they’ve onboarded a major client. In the meantime, R&D and product development work continues.

Perhaps unsurprisingly, Kallis sums up the year ahead as “not much sleep”.

Read on for the full story

Premium subscribers get the full story about Good With:

Upgrade your subscription now to learn about:

Good With’s funding and investment plans

The co-founders’ vision for the future of the company

How Good With squares up to the competition

What challenges the startup faces as it grows

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Full profiles of early-stage startups every Tuesday & Thursday: go deeper on each startup

- • Access to our acclaimed Startup Tracker database of early-stage UK startups