- PreSeed Now

- Posts

- Scaling up VC feedback with AI

Scaling up VC feedback with AI

Ada Ventures launches Deck Genius as a "gift to the ecosystem"

What does the head of product at a pre-seed VC firm do? You can find out today as Ada Ventures launches its new Deck Genius AI-based tool for founders, whether they’re pitching Ada or not.

Whether you’re an investor, a founder, or an interested bystander, this should be an interesting read.

– Martin

Trusted by millions. Actually enjoyed by them too.

Most business news feels like homework. Morning Brew feels like a cheat sheet. Quick hits on business, tech, and finance—sharp enough to make sense, snappy enough to make you smile.

Try the newsletter for free and see why it’s the go-to for over 4 million professionals every morning.

How Ada Ventures wants to help founders become pitch deck geniuses

Ada Ventures principal and head of product, Michael Tefula

It’s not uncommon for big VC firms to build their own tech products. These are often for internal use in sourcing or validating deals, or for supporting portfolio companies.

But it’s very rare for a pre-seed VC to have a head of product. That’s exactly what Ada Ventures has in Michael Tefula. And a year on from the launch of an AI-based pitch deck review tool called AdaGPT, they’ve launched Deck Genius, a more comprehensive tool for founders.

Founders just need to upload a PDF of their deck, and Deck Genius will provide “detailed, actionable feedback” in return.

Rather than simply act as a lead generation tool for Ada Ventures, it’s presented as more of a gift to the ecosystem. It’s free to use despite there being, I’m told, sizeable API costs to run it. Future plans for the tool include suggestions of investors who might be interested in a startup, based on the contents of its deck.

To find out more about Deck Genius, I spoke to Tefula, who balances his product role with more traditional VC investing as a principal at the firm.

This conversation has been edited for clarity.

MB = Martin SFP Bryant, MT: Michael Tefula

MB: So tell me about Deck Genius.

MT: It’s an evolution of our previous tool, AdaGPT. AdaGPT was about giving founders a really rapid feedback on their pitch decks, but with an Ada tilt.

The idea was you could get some rapid pitch deck feedback in plain text, and then you would get an alignment check with Ada Ventures. So if you're building a climate tech company or healthcare company, there was a very quick check to see whether the company was potentially a fit for the themes that we're investing in alongside feedback on the team and the product and all that jazz.

We've had 200 founders a month use that product, and they find it more useful than we expected. So we spent some time thinking about building something more sophisticated, something more intelligent, and something that will provide really actionable feedback to founders.

We've spent the last couple of months building Deck Genius, which is now in beta. The idea behind it is to go a step further than AdaGPT and actually build something that gives broader pitch deck feedback, taking the best-practice of venture and how VCs review pitch decks, embedding that into Deck Genius and basically having a tool that any founder can use.

MB: How does the tool work?

MT: All you have to do is upload your pitch deck in PDF form. We have over 20 different prompts and potentially up to 50 different LLM calls going on in the background to get really surgical feedback on the pitch deck. So in the background, it's really complicated, but on the surface, the founder gets feedback that goes in depth and is quite simple to digest.

The feedback is broken down into three broad categories. Firstly, the narrative of the deck. Is this a compelling story? At seed and pre-seed, maybe potentially up to series A, the story really matters. Then we look at the venture fundamentals. Is this a scalable venture opportunity that VCs would be excited about? And then we also look at design.

Those three components have slightly different weightings. At pre-seed, it's mostly about the story and the venture potential. As you scale up to seed and series A, the venture fundamentals matter a lot more than whether you've got dense text on a slide or not.

So within one to two minutes, founders get super detailed feedback. It's broken down the way that's digestible across those three areas. Then as they read the report, they can look at slide-by-slide feedback across the pitch deck.

We're giving founders feedback in a couple of minutes, which would ordinarily take two to three days, or in some cases, two to three weeks, because the average VC spends two to three minutes reading a pitch deck, but it can take them days or weeks to come back with feedback, and oftentimes the feedback is quite superficial, not because VCs are terrible people, but because we're just time-starved.

We have to go through thousands of pitch decks on an annual basis. As much as we'd love to give founders more detailed feedback, it's just not practical.

So Deck Genius is helping us, selfishly, scale up the advice we'd love to give to founders, but also, it just helps them set themselves up for success. Before they send their decks to investors, they can run it through Deck Genius and make sure that they're ticking off the things that really matter.

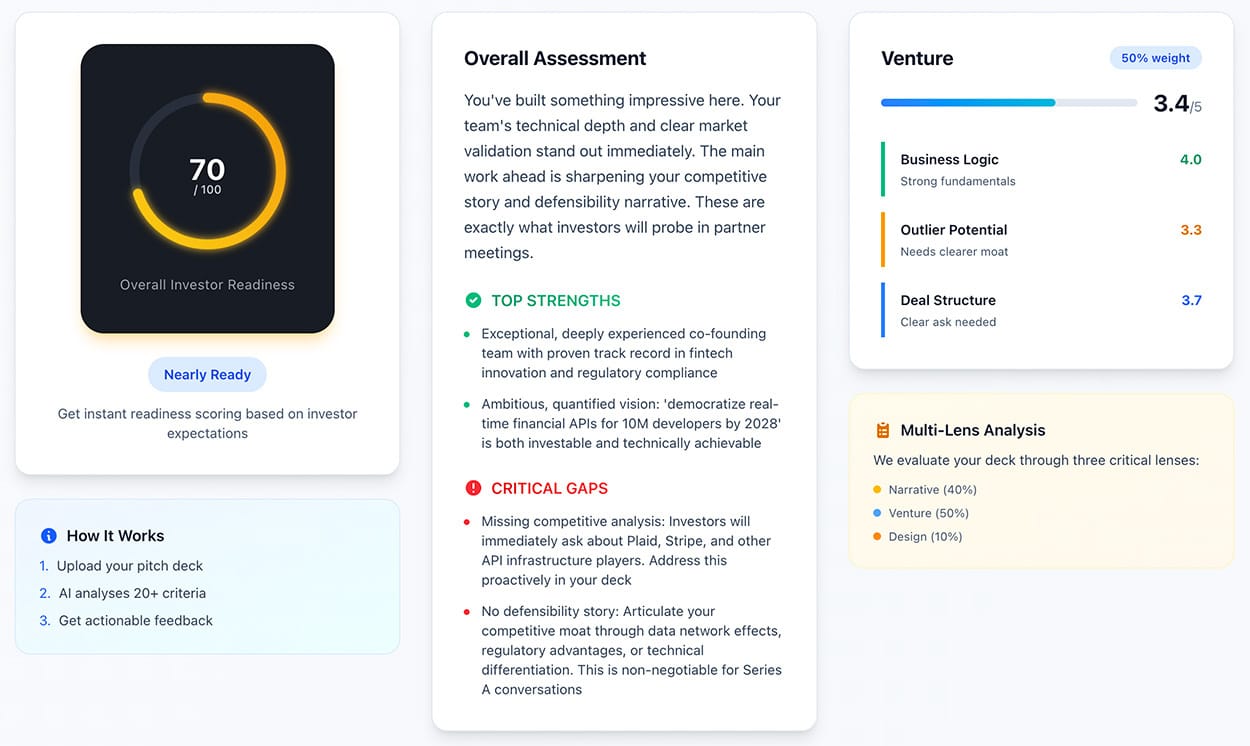

An example of some feedback from Deck Genius

MB: What is the thinking behind opening this up so it’s not just for people pitching Ada Ventures?

MT: We want to give more to the ecosystem. I think the more we can contribute to the ecosystem, the more amazing founders can start companies. And the more people we set up for success, hopefully the more people will be potentially interested in working with us.

So even though we've developed Deck Genius internally as one firm, we've actually been getting feedback from founders and other investors.

So at some point, we'd love to bring in other VCs to help us make this a much better tool for the ecosystem.

MB: What happens to the decks that are uploaded? Do you keep them?

MT: With AdaGPT, all the decks were automatically deleted, but we got feedback that actually some people wanted to retrieve the analysis. Instead of having it as a one time thing, they wanted to have the ability to go back and view the analysis so they could then refine their pitch deck.

So with Deck Genius today, founders have the option to ask for their pitch decks and analysis to be deleted. But automatically with any deck that runs through the system, which is done anonymously, founders get a retrieval code that they can use to get the analysis back for reference.

So if you're a founding team of two or three people, and one person's working on the deck, you can get that code and share it with the rest of the team so they can view the feedback and make use of it.

MB: You’re head of product at Ada Ventures. What does a head of product role at a VC firm look like?

MT: We've seen a couple of funds hire either product people or software engineers within their businesses, mostly because there's a massive opportunity now for venture firms. We're all investing in tech companies, but up until recently, a lot of VC firms haven't really been that software driven.

When I started in the venture business, which is not a very long time ago, everything was done in Excel. This was back in 2016, before CRMs took over, before people started automating their workflows with Zapier. At Ada, we saw that there's a massive opportunity now to tool ourselves with custom, proprietary software internally that can make us better investors and actually also start building products for founders that can help them have a much smoother founding journey from the outset.

You need someone internally to be a champion of different software products, whether those are products that we buy off the shelf or whether those are products we decide to build.

My role is primarily as an investor, but I spend a portion of the week looking at tools that we can use internally to make us better investors, whether that's our proprietary investment software or whether that's Deck Genius, which is a tool that's helping founders externally supercharge and refine their pitch decks.

MB: From all you’ve seen, what are some of the common mistakes founders make with their pitch decks?

MT: Where do I start? It varies based on domain and industry. But one thing that's a very easy to mistake is to start with the product and the technology in the first couple of slides. At pre-seed and seed, the first thing you want to start with is the team. There's no traction, there are no metrics, there's no revenue, typically there are no customers.

You want to start with the founding team, because at the very earliest stage, the bet that investors are making is that this team will build this thing and they'll get customers. But we need to believe that the team have the potential, the talent, to be able to do that.

So that's a very quick, easy fix for a lot of early-stage founders. Start with the team and then go into the problem, go into the solution, go into the go-to-market and all the other cool stuff later on, because the team really matters.

Show that you've got trajectory in your career. What have you achieved in the past that sets you up well to do really well in this specific area that you're building a company in? That's one of the things that is very easy to fix. But actually, a lot of early stage, pre-seed and seed decks have the team at the very end.

Find out more about Ada Ventures in our interview last year with co-founding partner Check Warner.

Were you forwarded this email? Subscribe here to get PreSeed Now straight to your inbox: